Dalet, a leading provider of software solutions for the creation, management and distribution of multimedia content for broadcasters, operators and content producers, has published its yearly audited results for financial year 2015 as approved by its Board of Directors on 21 April 2016*.

2015 was another year of robust growth for Dalet, with the completion of the reorganization of AmberFin (in deficit at the time of its purchase in 2014) and ongoing investment in growth (R&D, sales teams) setting the company on track to realize its full potential in the coming years.

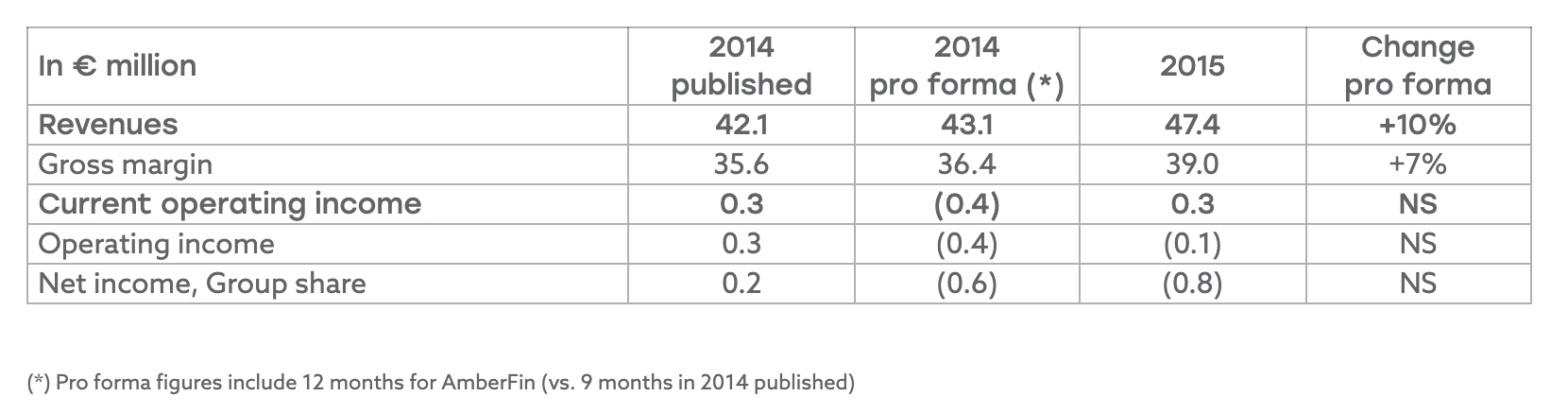

2015 financial results:

Dalet posted revenues of €47.4 million for financial year 2015, up 13% on the year before (10% pro forma). The breakdown in revenues was as follows:

- Software: €28.3 million (+14%). Dalet’s Software revenues were bolstered by the company’s maintenance-support contracts which, at €14.9 million, accounted for 31% of global revenues in 2015. License sales were stable at €13.4 million.

- Services: €9.2 million (-11%). The change in Services revenues in 2015 is directly linked to the sale of system-type projects which include integration and training professional services for the client.

- Hardware (storage, servers, etc.): €10.0 million (+27%). Hardware resale, a non strategic business for Dalet, grew significantly in 2015 due to a one-off exceptionally large contract signed with an operator which entrusted its entire infrastructure to Dalet.

This unusual weighting in hardware sales reduced the company’s gross margin (defined as sales minus cost of goods and third-party services resold) which amounted to 82% for the year as against 84% in 2014. In value terms, Dalet’s gross margin increased 7% to €39.0 million (pro forma).

Other operating expenses increased 5.2% (pro forma). The Group continued to strengthen its headcount, focusing notably on the strategic ramp-up of its sales teams for the Asia-Pacific region and its ongoing investment in R&D. The reorganization of AmberFin was also completed. The capitalization of €2.9 million in R&D on the company’s balance sheet had no significant impact on income as it was offset by the amortization of R&D expenses in a similar amount.

All told, Dalet posted a current operating income of €0.3 million which is consistent with the Group’s guidance published in February.

It also booked an exceptional (non cash) expense of €0.4 million linked to the impairment of goodwill on AmberFin, primarily linked to the fluctuation in the pound sterling. After €0.3 million in financial expenses and €0.3 million in tax, net income amounted to a loss of €0.8 million.

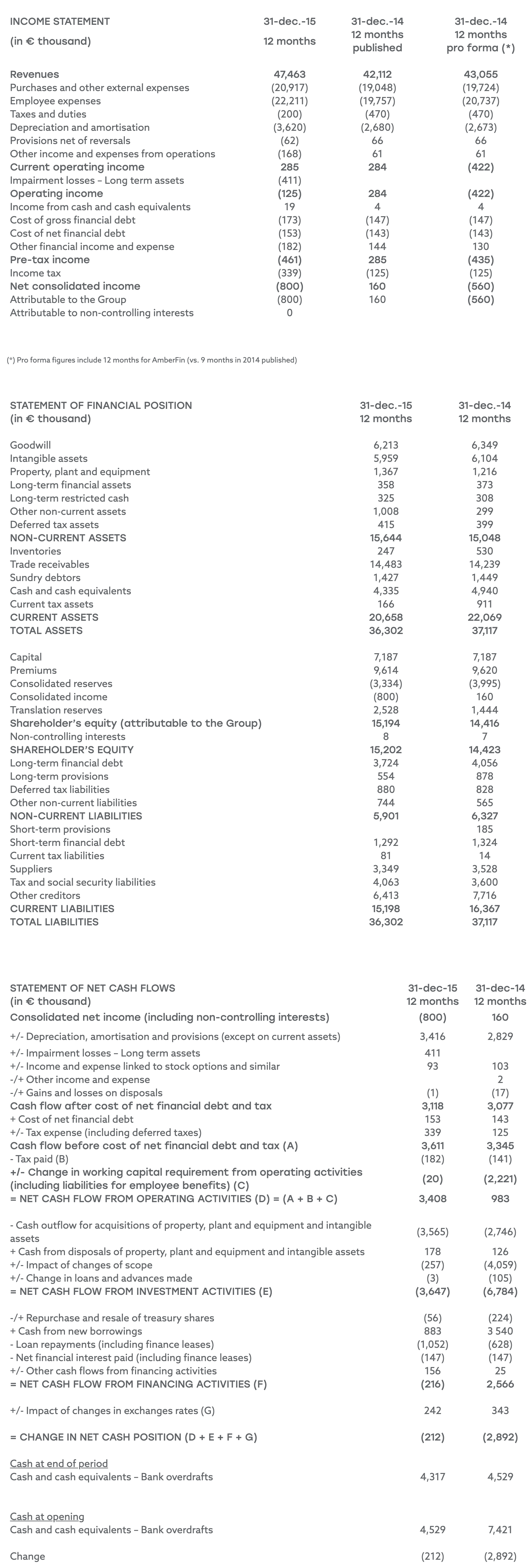

Healthy financial structure – Net debt close to zero

Dalet shareholder’s equity stood at €15.2 million on 31 December 2015. Cash flows linked to operations improved significantly, coming in at €3.4 million compared to €1.0 million in 2014, notably thanks to the Group’s careful management of its working capital.

These cash flows linked to operations covered almost all investments for the period (€3.6 million), most of which were linked to the capitalization of R&D. Net debt remained virtually stable at €0.6 million.

With cash assets of €4.3 million, Dalet has the sound financial structure it needs to pursue its development in the years ahead.

Outlook: Growth and improvement in margins

Backed by a high order backlog on 1 January 2016 (€36 million), and given the sustained demand for its software solutions and the cumulative increase in support contracts, Dalet confidently expects to continue growing its business in 2016.

The company should see a higher level of growth in its gross margin than in revenues as a result of the base effect linked to a single low-margin hardware sales contract signed in 2015.

One of the main priorities for 2016 is the gradual improvement of Dalet’s current operating profit. As it actively seeks out to grow its market share, the Group has set as a first target a current operating margin of 4 to 5% by 2017.

2016 will see the company focus on the implementation of an improved project management process (CMMI) in an effort to improve profitability. It will also benefit from the growing share of maintenance-support in its revenues as well as increased sales of its “plug and play” packaged solutions (Brio, AmberFin).

Dalet intends to uphold its ranking amongst the 3 leaders in its market which is undergoing concentration.

Next publication

Q1 revenues on 12 May 2016 after the close of trading.

About Dalet

Dalet solutions enable broadcasters and media professionals to create, manage and distribute content to both traditional and new media channels, including interactive TV, the Web and mobile networks. Dalet combines into a single system a robust and proven Asset Management platform with advanced metadata capabilities; a configurable workflow engine, and a comprehensive set of purpose-built creative and production tools. This integrated and open environment enables end-to-end management of the entire News and Sport and Program content chain, and allows users to significantly improve efficiency, and to maximize the use and value of their assets. Dalet’s solutions are delivered through a dedicated Professional and Integration Services Department to ensure the highest possible standards.

Dalet systems are used around the world by many thousands of individual users at hundreds of TV and Radio content producers, including public broadcasters (ABS-CBN, BBC, CBC, DR, France TV, RAI, RFI, RT Malaysia, VOA, WDR), commercial networks and operators (Canal+, FOX, eTV, Mediaset, NBC Universal, Time Warner Cable, Warner Bros., Sirius XM Radio) and government organizations (UK Parliament, NATO, United Nations, Veterans Affairs, NASA).

Dalet is traded on the NYSE-EURONEXT stock exchange (Eurolist C): ISIN: FR0011026749, Bloomberg DLT:FP, Reuters: DALE.PA. For more information on Dalet, visit www.dalet.com.

Contacts

Actus Finance & Communication:

Investors

- Guillaume Le Floch: 01 53 67 36 70

- Morgane Le Mellay: 01 53 67 36 75

Press-Media

- Vivien Ferran: 01 53 67 36 34

APPENDIX: DETAILED FINANCIAL INFORMATION 2015

*The consolidated financial statements have been audited in full. The auditors’ report will be published once the due diligence procedures required for the publication of the yearly financial report are complete.